Unveiling Order Blocks in ICT Trading Strategies

Introduction

These order blocks act as the foundation of ICT (Inner Circle Trader) trade strategies which provide insight into the operations and manipulations of the markets by institutions. Recognizing and making use of order blocks can bring about a “smart money” alignment to the trade, lending more credibility to traders’ results.

In this article, we will explain order blocks, how to identify them, and ways to integrate them into your trading strategy toward optimal effectiveness.

What are Order Blocks?

Order blocks are price areas where large institutional orders are placed and that create large swings in price. These price points signal either accumulation or distribution. Instead, they are smart money activity indicators.

Important Aspects of an Order Block: You may usually see a clear consolidation before a strong up or down move. Origin has an imbalance in price or fair value gap. Often at such areas, you will also find key support or resistance levels.

Why Order Blocks are Significant in ICT Trading?

- Identifying the Hidden Moves of the Institutions: Order block makes known the areas within which smart money is perhaps placing a trade.

- Refined Accuracy: Specific levels for entries, stop-loss placements, and take-profit targets.

- Market Reversals: Reversal points wherein price returns to that area.

How to Identify Order Blocks?

- Step 1: Look for Consolidation

- Locate an area in price that has consolidated for some time without more than a slight deviation before making a big directional move.

- Step 2: Analyze the Breakout.

- Break out offers a price imbalance that drivesa fair value gap or liquidity sweep.

- Step 3: Confirm with Volume or Candlesticks

Order block confirmation consolidation through volume spikes or candlestick patterns such as engulfing patterns.

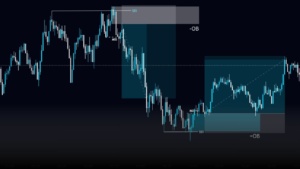

Order Block Types

- Bullish Order Block

- Located at the bottom of an upward move.

- Price retraces to this zone and takes support.

- Bearish Order Block

- Placed at the top of a downward move.

- Price comes back to test and then rejects this zone.

Using Order Block in Trading System

- Precise Entry

- Enter trades at the edge of the order block when the price retraces.

- Use with All ICT tools

- Integrate order blocks with liquidity zones, fair value gaps, or market structure, for higher probability trades.

- Manage Risk

- Put stop-losses slightly outside of the order block to prioritize.

Example of how Order Blocks move?

Let the market create a bullish price order block of $1,800 immediately after enduring a consolidation phase. Price pulls back to this zone and coincides with a fair value gap. Entering long at this price level with a stop-loss located just below the order block could possibly offer a high-probability trade setup.

Common Errors

- Failure to Confirm: Ever confirm with another tool or indicator.

- Lack of Consideration for Larger Timeframes: Assess order blocks on more than one-time frame to gain context.

- Enter Too Early: Wait until the price tests the zone.

What Next?

While order blocks are extremely powerful tools in and of themselves, their effectiveness increases exponentially when combined with other ICT strategies. In the next article, we will look into time and price theory and teach you how to synchronize your trades according to the natural rhythm of the market.

Call to Action

Want to unleash ICT’s full power? Keep checking up on our blog at The Traders Floor, follow us on Twitter, and join our Discord to get a glimpse of real-time trade ideas and insights. Stay tuned for more!