The Power of Liquidity Zones in ICT Trading Strategies

Liquidity zone is the prime concept that goes into the development of any trading strategies derived using ICT, which makes it important to learn how it works with regard to the greater market. This understanding gives traders an insight into the areas of price movements created by institutions, and this will enable the trader to align trades with the smart money.

In this article, we will open liquidity zones to you, tell you why they are important in trading and also teach you how to identify them on a chart and thus improve trading setups. This is applicable to both novice and veteran traders; mastering oneself in liquidity zones can be a game-changer.

What are Liquidity Zones in ICT Trading?

Liquidity zones are areas around which heavy institutional orders are likely to be hung and, therefore, significant price movement is expected to take place. These are supply and demand regions that potentially can cause price movements during revisit.

Key Features

- Areas of High Interest: Liquidity zones almost always coincide with major support or resistance levels.

- Institutional Participation: These zones represent areas where big players have made their positions on trades.

- Price Reactions: Sharp movements in prices are expected whenever these zones are targeted or visited.

Why Should We Care about Liquidity Zones?

- Spotting Smart Money Activity: Liquidity zones show the areas in which institutions order in their respective orders.

- Best Entry Points: In fact, those areas are entries where the price is likely reversing or consolidating to offer the best possible entry points to traders.

- Risk Management: Trading from liquidity zones gives a better chance to prepare a move in the price and handle the risk well.

How to Identify Liquidity Zones?

Watch for periods of consolidation since most liquidity zones form right before a dramatic price jump. Also, observe price normally moving a gap upwards, as this also is a sign of a liquidity zone. High volume values near certain levels often suggest the presence of liquidity.

For example, liquid areas form under a trending market by price filtering into a tight area before it breaks out. On return, this will be a fantastic entry point into a trade with the flow of the trend.

Liquidity Zones Trading Strategies

- Understanding Points for Entry and Exit

- Buy Orders: Identify liquidity zones that meet the strongest levels of support.

- Sell Orders: Look for liquidity zones that coincide with resistance levels.

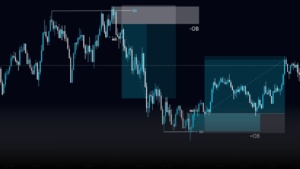

- Order Blocks with Liquidity Zones

Use order blocks to improve your trade entries with liquidity zones. An order block is a market area where institutional orders are taken. Liquidity zones signify where such orders are likely to be executed. They, therefore, ensure that you enter the trades at the right moments. - Risk Control: The liquidity zones depict the price ranges within which the trade will develop. You can, therefore, set up the stop loss outside that liquidity region for a better risk-reward ratio.

Avoiding Common Mistakes

- Ignoring Confirmation: Before trading in a liquidity zone, one must wait for price action confirmation.

- Trading Without Context: Sell high, but then ignore the historical price zones. Instead pay attention to market structure, current pricing trends, and order flow.

- Overtrading: Because liquidity zones are very important, it is important not to overtrade these zones as they may cause heavy risks.

Real-world Example