Mastering Supply and Demand in Trading: A Comprehensive Guide

Underlying the entire financial market is the supply and demand. They form the basis for price movement, induce imbalances in the market, and give trading opportunities. It is therefore essential for an ICT trader to know and identify these forces, as they mold the price action and influence the way the market will behave.

This article is all about elementary knowledge concerning supply and demand, the methods of identifying significant areas on the chart, and the different ways one can put them to use in one’s trading strategy.

What Are Supply and Demand Zones?

- Supply Zones: Price drops occur in areas where the selling pressure prevails over the buying interest.

- Demand Zones: Price rises occur in areas where the buying pressure overshadows the selling interest.

These zones are formed by the actions of the institutions within the market, where big orders buy or sell, leaving trails for the retail traders to evaluate.

Due to supply exceeding demand, prices drop. Otherwise, demand has to exceed supply for a price increase to occur. Such a struggle creates imbalances within the entire market, which is a foundation for identifying trading opportunities.

How to Identify Supply and Demand Zones on a Chart?

- Look for Sharp Price Movements

Often, supply and demand zones are around areas of price movements, such as:

-

-

-

- Long bullish or bearish candles.

- A gap where prices rushed through too fast to fill orders.

-

-

- Identify Areas of Consolidation

- Before sharp moves,the price typically consolidates. These areas of sideways movement indicate zones of institutional activity.

- Draw Zones Around Candles

- Mark Supply or Demand Zones by using the opening and closing of such consolidation candles.

Using Supply and Demand in ICT Trading

- Entry Strategies

- Wait for a price return to the identified zone.

- Look for confirmation signals such as candlestick patterns or liquidity sweeps .

- Risk Managment

- Place stop-loss orders just outside the zone, beyond the faith in false breakouts.

- Confluence with Other ICT Concepts

- Combine supply and demand zones with other ICT tools like order blocks, liquidity pools, or fair value gaps for high-probability setups.

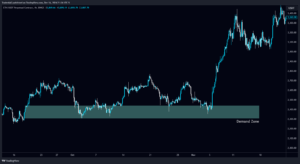

Sample Trade Setup Using Supply and Demand

- Target Demand Zone: There is a sharp vertical rise from $2865 to $3000. The area of consolidation was between $2865-$3000: that is your demand zone.

- Wait for Retracement: The price comes back and touches the demand zone: this is your cue to buy.

- Enter Trade: Enter long with stop loss underneath $2757 after confirmation, say bullish engulfing candle.

More Advanced Secrets of Trading Supply and Demand:

- Combine supply and demand with time frames: Use higher time frames to confirm the trend and lower time frames for precision entries.

- Be aware of liquidity sweeps: When price spikes into a zone before reverting, this is time for liquidity sweeps.

- Watch for imbalances: These highlight zones where institutional orders may remain unfilled, creating opportunities for retracement.

Common Mistakes to Avoid

- Ignoring Market Context: Always take heed to trend and have your trade when dealing with supply and demand zones.

- Drawing Wrong Zones: Keep it realistic: Focus on price movements, but never minor ones.

- Confirmation was Dismissed: Trade should never be entered just because of the zone; confirmation should be awaited instead.

What’s Coming Up Next?

Our next post focuses on the Rally Base Rally – Bullish Continuation Pattern with the power to enhance one’s understanding of price inefficiencies in ICT trading strategies. Pretty great stuff, right.

Call to Action

What more could you want on ICT trading strategies? Bookmark The Traders Floor follow us on Twitter and Discord for live trade ideas and updates, and join the thriving trading community.

7 Comments

Jhon Miller

Thank you for always fast and effective service. The updates are really important for us!

Martin Moore

I liked working with your consultants a lot!

David Matinson

We appreciate your feedback!

David Matinson

We appreciate your feedback!

David Matinson

We appreciate your feedback!

David Matinson

We appreciate your feedback!We appreciate your feedback!

Miki Williams

The customer support is awesome! The tech issue we were having was resolved in no time, thanks