Mastering Order Blocks in ICT Trading Strategies: A Comprehensive Guide

Introduction

Order blocks are one of the most essential components of ICT or Inner Circle Trader trading strategies as they are footprints of the institutional activity in trading. These order blocks give a clue as to where smart money enters or exits from trades, and retail traders can align their direction with their positions according to them. In the following post, the concept of order blocks will be explained in detail along with their significance and actionable takeaways to incorporate them in your trading strategies.

Be it a novice or seasoned trader, mastering order blocks as a trading concept will get you up a notch on your trading game and keep you out of the typical traps.

What Are Order Blocks in ICT Trading?

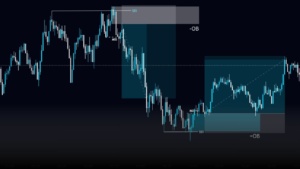

Order blocks are defined as blocks of time on a price chart that large institutions execute bulk orders. These price ranges frequently are actual barriers, either key support or resistance, and, as a result, show significant reactions when revisiting this price zone.

Order blocks fall into the following categories:

- Bullish Order Blocks: Formed ahead of the move in price upwards.

- Bearish Order Blocks: Formed just before the price moves downwards.

These may be seen as identified points of the market where a reversal or consolidation is probable.

What is the Importance of Order Blocks?

- Institutional Footprints: They indicate the place of the smart money’s operation.

- Trade Precision: Helps the trader specify entry and exit points very sharply.

- Risk Management: Aligns trade in the place of the institution trend so that it minimizes losses.

How to Identify Order Blocks?

To identify the presence of order blocks in a chart:

- Study Candle Patterns: Look for consecutive bullish or bearish candles before a strong movement in price.

- Volume Analysis: High volume indicates these moves are usually because of institutions.

- Confirmation with Breakouts: The price usually breaks key levels after the creation of an order block confirming its existence.

Example:

Imagine a bullish order block being created after the consolidation phase. When the price retraces to this block, it often rebounds, giving a clear entry point for long trades.

Trading Strategies with Order Blocks

- Entry Points: Buy on Bullish Order Blocks and Sell on Bearish Order Blocks upon confirmation signals such as candlestick patterns or momentum indicators.

- Stop-Loss Placement: Place a stop-loss just outside of the order block to minimize risk.

- Combine with Market Structure: Synchronize order block trading with market structure which would increase the probability of the trade success rate. That is: trade bullish order blocks in an uptrend, contrary, bearish order blocks in a downtrend.

Mistakes that Should Not be Made

- Trading Without Confirmation: Always wait for a retest or breakout before entering.

- Not Considering Volume: Low volume may denote a weak order block.

- Overcomplicating the Analyses: Focus on straight and very obvious order blocks.

Example in Real Life

Say the price of BTC will create a bearish order block at $38,000. After a retracement, it rejects this level and drops to $36,000. By identifying that order block, the trader could have gone short.

What’s Next?

Order blocks are very critical aspects of ICT trading strategies but are not the end of the puzzle. In the upcoming publication, we’ll cover the topics of imbalance and fair value gaps that go hand-in-hand with order block analysis to further improve trading precision.

Call to Action

Bookmark our site, The Traders Floor, to keep yourself updated on our next article in the ICT trading strategies series. Join our Discord and follow us on X for live updates and trade ideas.