Mastering Market Structure in ICT Trading Strategies

Introduction

The market structure is the backbone of successful trading. Trading without a clear understanding of market structure will lead you to a lot of unfortunate losses. Good market structure understanding in ICT (Inner Circle Trader) strategies will give a trader the intuition of the market movements and bring about better trade alignment with the flow of smart money.

In this post, we’ll throw more light into what market structure is along with its components, and how mastering it can skyrocket your trading. Understanding market structure is good for both beginners and experienced traders wanting informed decision-making.

What Is Market Structure?

Market structure reflects the natural ebb and flow of price movement, which is the best indicator of the supply and demand relationship underneath it. It provides the contouring structure within which the market functions, hence providing traders a means of identifying trends to reversals.

Three Major Phases of Market Structure:

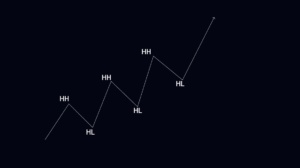

- Uptrend: A series of higher highs (HH) and higher lows (HL).

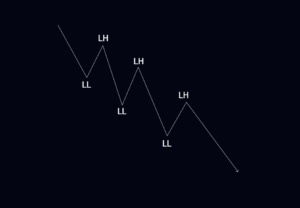

- Downtrend: A sequence of lower lows (LL) and lower highs (LH).

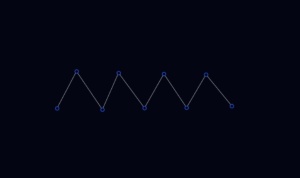

- Consolidation: Static sideways price movements.

Why Market Structure is Important in ICT Trading

- Market Clarity: Provides a way of knowing whether the markets are bullish, bearish, or something else entirely – consolidation.

- Accuracy of Entry Positions: Helps you align your trades with the most dominant trend for successful entry.

- Trend Change Forecasting: Ability to Learn to spot early signs of trend changes to secure profits or protect against losses.

Analyze Market Structure

Identify Current Trend First

- Look form of HH and HL at the uptrend.

- Find the LL and LH forms in the otherwise downtrend.

Recognize Key Levels

- Support Levels – Areas where price tends to bounce upward.

- Resistance Levels – Areas where price often reverses downward.

Confirmation Instrument

Market structure analysis must be enhanced with Mis-Balance, Order Blocks, and Liquidity zones to confirm findings.

Apply Structure in Trading

- Trading Towards The Trend

- Always trade in the same direction with the dominant trend. To illustrate: in an uptrend, seek out higher low buy trades.

- Spotting Reversals

- Monitor significant levels of support or resistance. A break and close above resistance in a downtrend signifies a possible reversal of trend.

- Joining Strategies with ICT

- Combine market structure with ICT concepts such as the fair value gap, and liquidity zones for fine-tuning.

Here is how the Market Structure Performs:

Assume the market goes up forming a series of HH and HLs. You see a pullback to the previous higher low where this is in confluence with a fair value gap. This signifies an area that is favorable for buying.

Common Mistakes

- The Bigger Picture: Analyze timeframes concerning the market structure.

- Complicate Things: The simpler ones are higher highs, lower lows, and key levels.

- Ignoring Proper Risk Management: Always put stop-losses according to structure.

The Next Step

Market structure is integral to every ICT trading strategy. Following this, we will see the role of timeframes in fine-tuning your trades and aligning them with market structure for maximum accuracy.

Call to Action

Mastering market structure is just the beginning. Bookmark our blog at The Traders Floor, follow us on Twitter, and join our Discord to access live trade ideas and insights. Stay tuned for more ICT trading strategies!

2 Comments

Martin Moore

The bloggers are doing a huge favor for the miners! Thank you guys, you rock!

David Matinson

You’re welcome to join our community!